Introducing Venice: The last financial data integration you'll ever need.

Apr 7, 2023

"Wait, everyone builds this?!"

There used to be a good reason why companies would build their own financial data integrations: no one else was building them.

So, you'd roll up your sleeves and start building everything from scratch for each data source you needed:

infrastructure

backend APIs

data schema transformations

ETL / ELT into your database or data warehouse

web hooks for updates

data normalization to unify disparate data sources

data enrichment on top of the raw data

API & auth updates as external data sources evolve

And at the end of all that work, you'd typically end up exactly where all your competitors would end up: with a basic, semi-functional data integration. It wasn't pretty, but it was a starting point. The downside is that starting point often takes companies months or years to get to before they can start to focus on the real value of their business (& the real value customers cared about), delaying revenue an uncomfortably long time.

Even worse, if that data source didn't quite move the needle for your business and you needed another, the clock started over again and your team was forced back into build mode for weeks or months. Another data source, another delay on revenue & customer value. Another recreation of another wheel that all your competitors were also building.

Our unfair (open & extensible) advantage

Even today, there are only a small number of closed-platform companies building a small number of integrations. The inherent problem with those is the same reason banking connectors break in your favorite app: they're always missing one or more financial data sources that you or your customers need; there's always an edge case. Or when a data source is supported, they can sometimes be unreliable and you'd prefer to use a different data provider instead.

Until Venice, there was nothing you could do about these problems. Your only option was to plead with your closed-platform data integrations provider to prioritize building the data source you needed—that meant they'd need to evaluate the return-on-investment of doing so and possibly even hire more engineers, raising costs for all. Sometimes your incentives and roadmap aligned with theirs, but other times you felt the pain so viscerally that you again decided to roll up your sleeves and build your integrations from scratch. You'd justify it as "We'll just do it for this one, it can't be that hard. Besides, we're using them for all the others." Another slipped schedule—and another expensive build process—all because you couldn't extend a closed system.

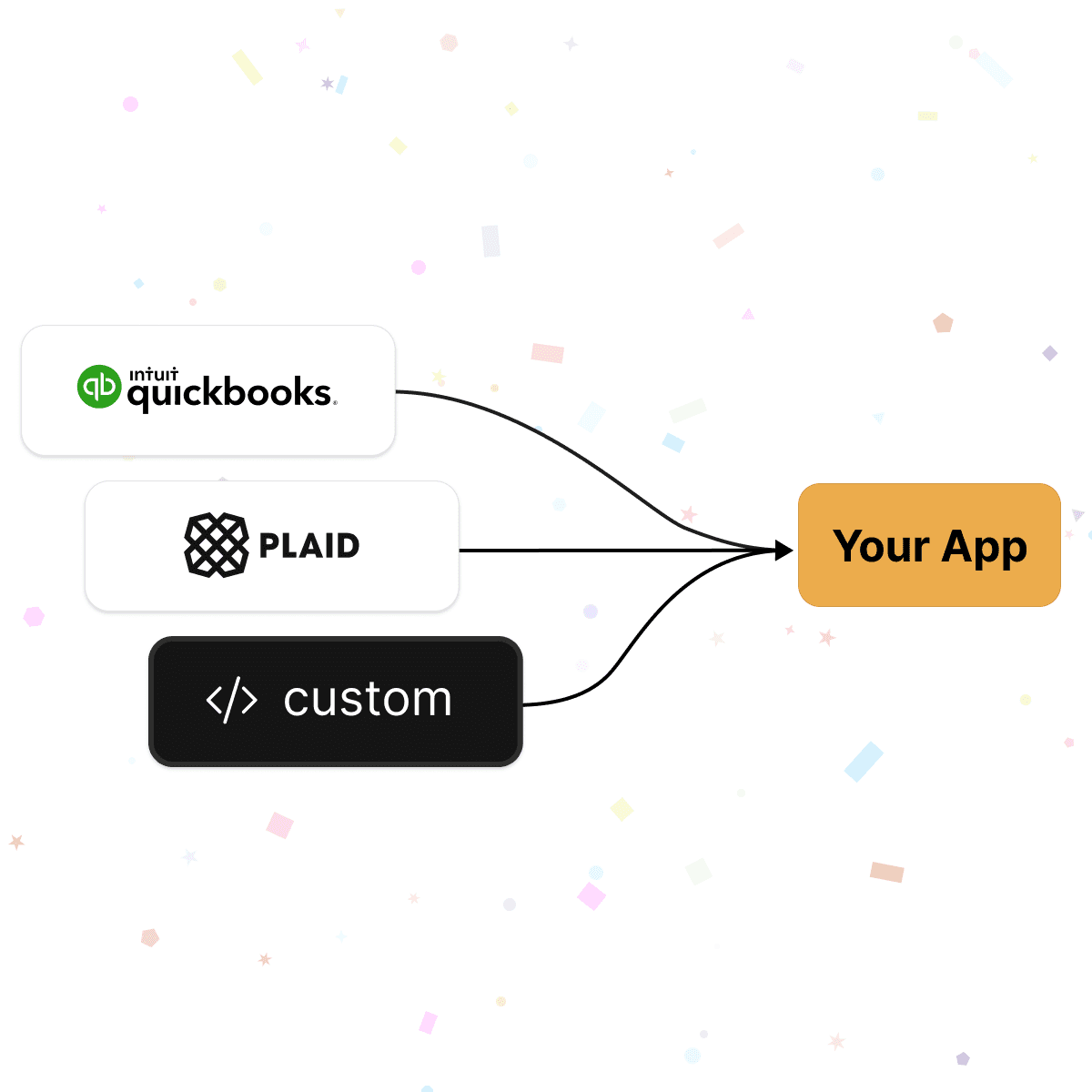

With Venice, in the unlikely scenario our global community of developers isn't building a data source you need already, adding a new one yourself takes hours—not months. All the data engineering infrastructure works just the same, and you can extend Venice to your needs. If it's a data integration you care about, we want to empower you or someone in the world to build it. That's what it truly means to care about the customer's needs.

In fact, we're so agnostic as to which financial data sources you need access to that we're happy to treat any other financial data integrators / aggregators as a data source within Venice as well. If it helps unify your data model and build faster, we want to support you.

Help us commoditize integrations & amortize cost for all

As lead engineers for over a decade now—having built Segment and multiple fintechs—we can safely say engineers are happiest when they don't have to build everything themselves. Everyone wants to feel like they have superpowers, so they can give their customers superpowers.

That's why it's our mission to commoditize financial data integrations once and for all. Rather than locking integrations behind a walled garden, we want to empower the entire world to share the burden of building and maintaining them, ultimately lowering the cost & maintenance headaches for all involved. Rather than you having to hire 3 or 4 engineers ($500k/year), you can leverage the world's experts for free and get to market faster in an increasingly competitive landscape.

A new day is rising where choosing anything other than Venice for your financial data connector needs would be fiscally irresponsible. With a global community, we can all lower the costs down to zero.

A marketplace to lower the friction for all

Along the way, we'll be building up a marketplace to connect:

data providers (e.g. banking, accounting, commerce, aggregators)

data enrichers (e.g. business intelligence, underwriting & loan analysis, transaction cleansing)

data consumers (e.g. you, your companies, and your customers)

In a world where it still takes weeks to build even the simplest of data integrations, we want you to have the power of data & enrichment at your fingertips with the flip of a toggle switch. When we say frictionless, we really mean it.

For companies, we want to empower your sales teams to offer Venice as an "easy button" for getting the data you need to sell your services (e.g. like data enrichers asking customers to come back once they've integrated with Plaid).

For startups, we want to provide a targeted place for you to acquire your first B2B fintech customers.

We mean it when we say openness and collaboration are virtues of ours. We can all change the world together, and we're excited for the opportunity to partner with you over the years ahead.

Reach out, and let's get building!

P.S. if you're interested in investing, we'd love to talk